What Is a Payment Gateway?

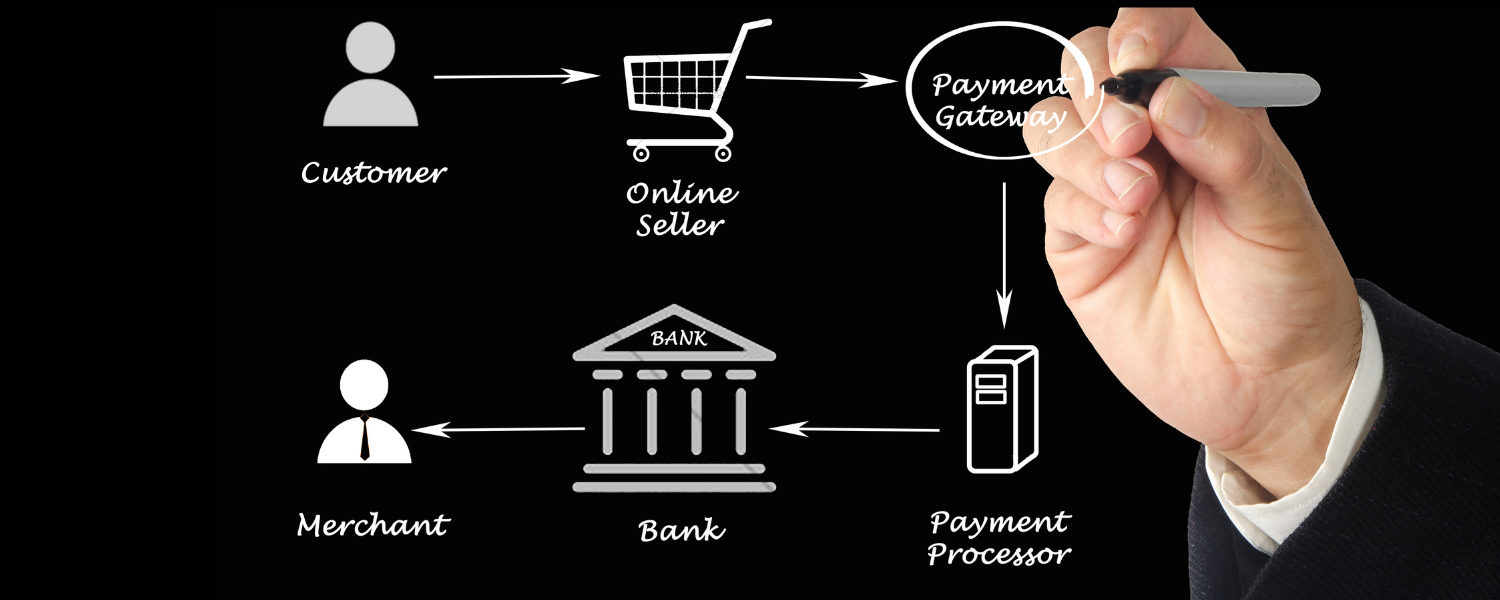

The duty of a payment gateway includes checking the details of customer payment methods, ensuring the availability of sufficient funds, and then making payment to the merchant.

A payment gateway is a middleman that ensures that the transactions are done securely and quickly from the end customer to the business.

It plays a major role in ensuring the success of payments and provides convenience to the customers in terms of paying for their subscription. A payment gateway is a service offered by either a bank or any other payment service provider which is authorized by a bank.

How Do They Work?

An online payment gateway provides a system or a means of conducting payment to online businesses. It often completes the process with the help of credit or debit cards or other online modes of payment.

It navigates the customer to the checkout section of your website and there it connects the payment data of the customer. After that, the payment gateway transfers the payment details of the customer along with the total bill and the details of the transaction to the payment processor which might be the acquiring bank or the merchant bank.

This complete process is conducted by the payment gateway securely. After this, via the card network, the information goes to the issuing bank of the customer where the transaction is authorized. The authorized transaction then comes back to the payment gateway where the customer is informed that the transaction is successful.

However, in some cases due to problems such as insufficient balance or server down, the transaction can be returned as unsuccessful. In such cases, the payment gateways send the money back to the account of the customer, if deducted.

Why Do Payment Failures Happen?

Payment failures are disheartening both for the businesses and the customer. If the customer faces payment failure, they might not risk attempting the payment again instead choosing to leave your site without checking out a subscription. Because of this, they pose a massive risk to your business. Payment failures can occur if-

The payment gateway is down.

The bank does not allow the transaction.

The card used for payment is expired.

There are insufficient funds in the account.

The bank has detected fraud.

The bank has cancelled the card.

The information added is incorrect.

The payment method is not supported by the payment gateway.

The account has been closed.

The card is reported to be lost or stolen.

While the cause of the trouble might not be the fault of the business, sometimes payments fail due to faults at your end. In such cases, you should try to fix the faults for customer retention.

What Is Failed Payment Recovery and Why Use It?

Failed payment recovery is the method that businesses use to try to recover or retrieve lost revenue from customers who’ve experienced payment failures.

It is also known as dunning management and involves practices such as retrying failed payments, sending emails to the customer apologizing for the inconvenience, and allowing the customer to update their payment methods.

It is important for subscription-based models to retain the customers so that they do not stop using your services due to a bad payment experience.

What to Consider When Choosing a Payment Gateway Package?

Before choosing the right payment gateway to partner with for your business, you should keep in mind certain factors. After all, you have to build the trust of your customers, and you cannot let a third-party payment gateway jeopardise that relationship. The things you should consider include the following -

1.Security

How the payment gateway deals with the plethora of sensitive financial information it handles. Customers entrust your business or e-commerce store to secure this information. Therefore, you should partner with a secure payment gateway that provides the most robust levels of security.

In this regard, a payment gateway that has a good reputation and experience in providing safe checkout experiences for customers should be taken into consideration.

2.Payment Methods

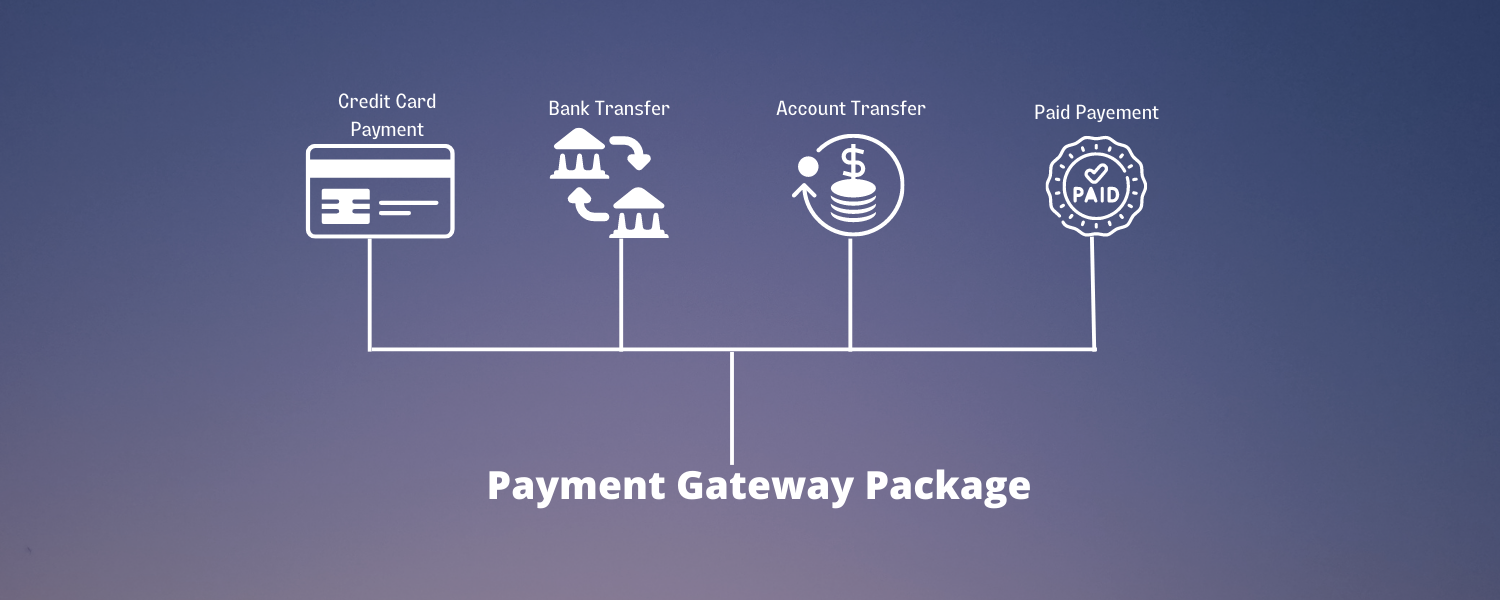

Payment gateways that offer multiple payment methods for customers to choose from is preferred by customers because it gives them payment flexibility. This makes it easier for the customers to make purchases as they can choose the payment method of their choice.

If they are unable to find their preferred payment method, they might stop purchasing from your business or e-commerce store. Therefore, you should collaborate with the payment gateway in e-commerce that offers your customers the chance to choose from multiple payment methods including credit and debit cards, online banking, other online payment methods et cetera.

3.Fees

Every business needs to pay transaction fees to the payment gateway that they're using. Therefore, it is important for you to check the fees demanded by a payment gateway before selecting it. You should make a comparison between multiple payment gateways before integrating them into your site.

Also, the fees applied should be transparent and no surprise charges should be applied to the business for the transactions. Some of the important fees include statement fees, merchant account fees, transaction fees, chargeback fees, etc. Your payment gateway should not apply additional or hidden fees either to the customers or to your business.

4.Integration

It is important to check the level of integration of a payment gateway with your current platform from the technical and design point of view.

The integration should be smooth and should not cause any errors or troubles for your website. There are many payment gateways that can be customized to match the design of your website and are also compatible with your brand.

If you choose a payment gateway that is not adequately matched with your website, you might deteriorate the customer experience.

How to Detect and Prevent Online Fraud?

We will now cover a few ways in which you can detect and prevent instances of online fraud through your payment gateway.

1.CVV or Card Verification Value

The three or four-digit code that is often found on the backside of a debit card or credit card is known as the card verification code or the CVV. CVV of any card is not stored on the database of the merchant.

While all other details of the cards are stored with the merchant, the CVV has to be entered each time the customer wants to make a purchase.

If your business receives an order on which the CVV entered does not match with the actual CVV of the customer, which is there on the card, the transaction should be declined by your e-commerce payment gateway. You can also enable a CVV filter, which will help your merchant detect fraud and reduce chargebacks.

2. AVS or Address Verification Service for Purchasing Any Item

The customers have to enter their billing address along with their ZIP code. The address verification system or an AVS, checks if the address which is added to the billing address section actually matches the address that the card issuing bank has.

The payment gateway sends a request to the bank for verification of the customer address as a part of CNP or “card not present” transactions. The AVS helps the merchant understand if both the addresses are matching or not.

If not, the e-commerce payment gateway should check the CVV, IP address, email address, and other important things on the transaction to be sure that the authentic customer is making the purchase. If not, the purchase can be declined.

3.Pair Authentication

The pair authentication method also known as Verified by Visa or MasterCard secure code is an authentication measure of the cardholder that helps in securing online transactions.

With this method, the card holders can create a PIN that can be used to confirm the identity of the user while checking out with the purchase.

This helps the merchant to obtain chargeback protection and lower the rates of interchange. It is an important fraud prevention tool used by businesses to secure their interests.

4.Logout Mechanisms

This is a type of fraud prevention system that can detect fraudsters who use hacking programs such as automatic card number generators. This program generates multiple valid credit card numbers out of which the fraudster can use one to try and make payment on the website payment gateway.

He can use that credit card number to purchase an item, and the customer will be charged without actually buying something. To prevent such kind of fraud from happening, the merchants can either lockout transactions that are occurring from a single IP with multiple credit cards declined within a timeframe.

They can also disable transactions that are unable to pass the AVS test as the fraudster does not know the address on the account of the customer.

5.Risk Scoring

Risk scoring tools are some tools that are based on statistical models and are used to identify fraudulent transactions, on the basis of a number of rules. Whenever a payment is made on the website, with the help of these tools, you can identify the chances of the transaction being fraudulent.

If the chances are high, you should verify the orders by other methods of verification. Risk scoring tools are very important to flag transactions based on multiple rules such as AVS failure test, IP change, billing address, anonymous emails et cetera.

6.Device Identification

This method is used to identify the device that is being used to make the transaction. It is then compared with the frequent or registered devices of the customer.

This method includes profiling the operating system, browser, internet connection et cetera. It makes use of the unique device fingerprints available on all devices including phones computers tablets et cetera so that fraudulent patterns can be identified, and risks mitigated.

7.Large Transactions

Whenever a fraudster steals card information, they try to make a large transaction before the customer blocks the card.

Therefore, whenever you witness a very large transaction, you should check it for any fraudulent activity before accepting the payment. You can also limit the number of large transactions made by a single customer.

8.High-Risk Countries

You need to be careful about the orders being made from the highest risk countries which have the maximum level of online fraud rates such as Egypt, Pakistan, Ukraine, Romania, Nigeria, Malaysia, Bulgaria et cetera. You should identify the customers' identities from the bank before allowing the transaction.

FAQs

Q- What Are Payment Gateways?

Ans- The checkout portals which act as the medium through which the customers pay to the businesses as known as the patent gateways.

Q- How Do Payment Gateways Work?

Ans- The payment gateways verify the card details entered by the customer, check if they have enough balance and then transfer the money to the businesses.

Q- What Are Examples of Payment Gateways?

Ans- Some famous payment gateways include PayPal, Amazon Pay, WePay, Authorize.net etc.

Q- What Are the Types of Payment Gateways?

Ans- There are three types of payment gateways- hosted, self-hosted and API hosted payment gateways.