Get your books done for you with our accounting integrations

Our accounting integrations provide you with automated synchronisation of invoices, credit notes, transactions and all other associated data into an accounting software of your choice.

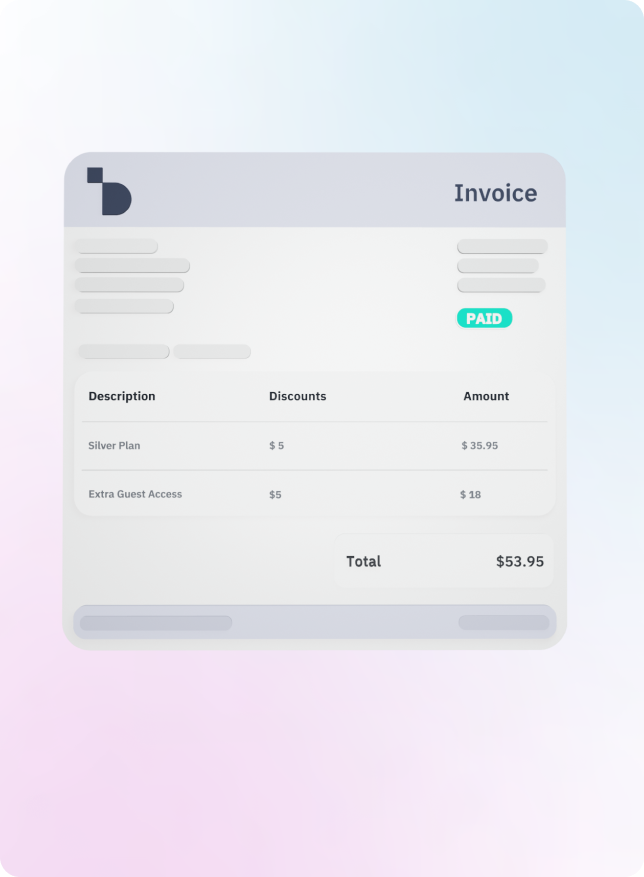

With it's interactive right hand panel, customers can manually attempt invoice payments, replace expiring cards and even contact your customer service all from their invoice.

Don't worry about sending your customer payment confirmations again, the Billsby Advanced Invoice will automatically update when an invoice has been paid, left unpaid, refunded, or even written-off.

Provide us with your styling guidelines and functionality preferences and we'll make sure your invoices not only feel native to your brand identity, but that they're also working exactly how you need them too.

When needed, you can use the Billsby Advanced Invoice to reduce manual tasks by prompting your customers to take action.

Our accounting integrations provide you with automated synchronisation of invoices, credit notes, transactions and all other associated data into an accounting software of your choice.

"Exceptional support and ease of setup"