With the evolution of technology, subscription businesses now have access to powerful tools such as accounting software to streamline their financial processes. In this article we delve into the importance of accounting software for subscription businesses, the key features to look for when choosing the accounting software to utilise in your business, and explain how Billsby, one of the world’s leading subscription billing engines, can help your subscription business maximise its revenue earning potential.

1. What is Business Accounting?

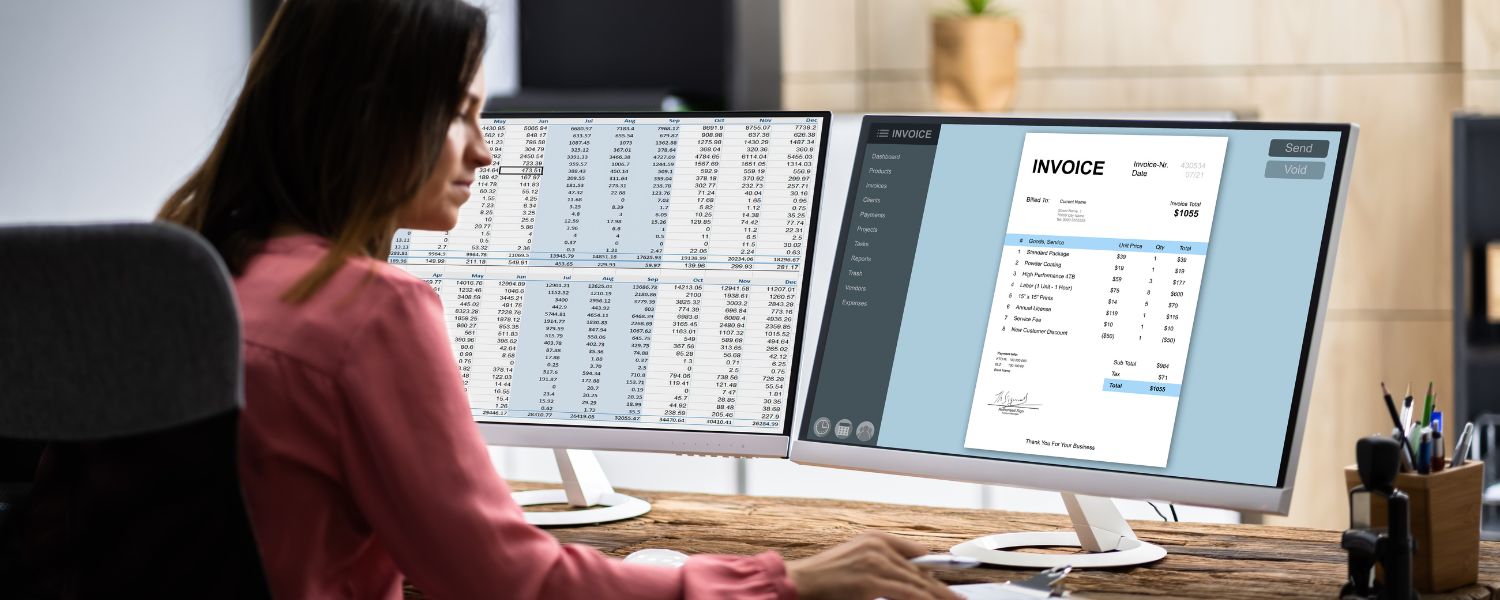

Business accounting involves the systematic recording, analysis, and reporting of financial transactions. It provides insights into the financial health of a business, enabling informed decision-making and compliance with regulatory requirements. Traditional accounting methods often rely on manual data entry into ledgers and spreadsheets, leading to errors and inefficiencies. However, with the development of accounting software, businesses are able to automate many financial tasks, reducing the risk of errors and saving time.

2. Why is Accounting Software Important in Business Accounting?

Accounting software plays a crucial role in modern business accounting for several reasons:

Efficiency: Accounting software automates repetitive tasks such as data entry, invoicing, and reconciliation, saving time and reducing the risk of errors. This allows finance teams to focus on strategic activities that add value to the business.

Accuracy: Manual data entry is prone to errors, which can lead to financial discrepancies and compliance issues. Accounting software automates calculations and ensures data accuracy, providing a reliable basis for decision-making and financial reporting.

Compliance: Accounting software helps businesses stay compliant with tax regulations, accounting standards, and industry-specific requirements. It generates reports, such as income statements and balance sheets, that comply with regulatory guidelines and facilitate audits.

Scalability: As subscription businesses grow, their accounting needs become more complex. Accounting software can scale with the business, accommodating increased transaction volumes, multi-currency transactions, and additional users without compromising performance or accuracy.

Visibility: Accounting software provides real-time visibility into financial data, enabling stakeholders to monitor cash flow, track expenses, and analyze performance metrics. This visibility facilitates informed decision-making and strategic planning.

3. Key Features of Accounting Software

Invoice Processing: Invoice processing is a fundamental aspect of business accounting, as it involves generating, sending, and tracking invoices for goods or services provided. Accounting software streamlines this process by allowing users to create customized invoice templates, automatically generate recurring invoices, and send invoices electronically via email or integrated payment portals. Additionally, accounting software tracks invoice status, payment due dates, and overdue payments, facilitating timely follow-up and cash flow management.

Online Payments: Integration with online payment gateways enables businesses to accept payments securely and efficiently. Accounting software allows customers to make payments electronically using credit cards, debit cards, or digital wallets, with transactions automatically recorded in the accounting system. This streamlines the payment process for both businesses and customers, reducing manual effort and accelerating cash flow.

Accounts Payable: Efficient management of accounts payable is essential for maintaining vendor relationships and optimizing cash flow. Accounting software automates the accounts payable process by capturing invoices electronically, matching them to purchase orders and receiving reports, and routing them for approval. Once approved, invoices are processed for payment, with accounting software generating checks or initiating electronic transfers directly from the system. By automating accounts payable tasks, businesses can reduce processing time, minimize errors, and take advantage of early payment discounts.

Banking: Integration with banking systems enables real-time synchronization of financial data, including transactions, balances, and reconciliations. Accounting software automatically imports bank transactions into the system, categorizes them based on predefined rules, and reconciles them with corresponding entries in the accounting records. This streamlines the bank reconciliation process, improves accuracy, and provides a comprehensive view of cash flow, enabling businesses to make informed financial decisions.

Reporting: Comprehensive reporting capabilities allow businesses to analyze financial performance, track key metrics, and identify trends. Accounting software generates customizable reports, such as profit and loss statements, balance sheets, cash flow statements, and aging receivables reports, which provide insights into revenue, expenses, assets, liabilities, and equity. These reports can be tailored to meet the specific needs of stakeholders, such as investors, lenders, and regulatory authorities, and can be exported in various formats for further analysis or distribution.

Inventory: For businesses that deal with inventory, accounting software helps track stock levels, monitor inventory costs, and manage reorder points. Accounting software integrates with inventory management systems to update inventory records in real-time, reconcile inventory counts with financial records, and generate reports on inventory turnover, stock valuation, and reorder requirements. By optimizing inventory management, businesses can reduce carrying costs, minimize stockouts, and improve overall operational efficiency.

Time Tracking: Some accounting software solutions offer time tracking functionality, enabling businesses to track billable hours, manage employee schedules, and allocate resources efficiently. Time tracking features allow employees to log hours worked on specific projects or tasks, track time spent on billable activities, and submit timesheets for approval. This data can be used to calculate payroll, invoice clients for services rendered, and analyze resource utilization to optimize productivity and profitability.

4. How to Pick the Right Accounting Software for Your Subscription Business

When choosing accounting software, subscription businesses should consider the following factors:

Business Size: The accounting software should be scalable to accommodate the current and future needs of the business, whether it's a small startup, a growing mid-sized company, or a large enterprise.

Industry-specific Requirements: Some industries have unique accounting needs, such as project-based accounting for professional services firms or inventory management for retail businesses. Choose accounting software that can meet these specific requirements.

Budget: Consider the cost of the accounting software, including subscription fees, implementation costs, and ongoing support fees. Compare pricing plans from different vendors and choose a solution that offers the best value for money.

Usability: The accounting software should be user-friendly and intuitive, with an interface that is easy to navigate and understand. Conduct a trial or demo of the software to assess its usability before making a decision.

Integration Capabilities: Ensure that the accounting software integrates seamlessly with other business systems and applications, such as ERP software, CRM systems, SaaS billing platforms, and payment gateways. This ensures data consistency and eliminates the need for manual data entry.

Customer Support: Choose a vendor that offers reliable customer support, including technical assistance, training resources, and ongoing updates and maintenance. Responsive customer support is essential for resolving issues quickly and maximizing the value of the accounting software.

5. Accounting Software for Small Businesses

Small businesses often have limited resources and accounting expertise, so they require accounting software that is easy to use, affordable, and scalable. Look for solutions tailored to the needs of small businesses, offering features such as invoicing, expense tracking, tax preparation, and financial reporting. Cloud-based accounting software is particularly well-suited for small businesses, as it offers flexibility, accessibility, and cost-effectiveness without requiring significant upfront investment in hardware or infrastructure.

6. Accounting Software for Large Enterprises

Large enterprises have more complex accounting needs, including multi-entity consolidation, global tax compliance, and advanced financial reporting requirements. Choose accounting software that is robust, scalable, and customizable to meet the unique needs of large enterprises. Look for features such as multi-currency support, advanced analytics, role-based access controls, and enterprise-grade security features. Additionally, consider the vendor's track record in serving large enterprise clients and their ability to provide tailored solutions and ongoing support.

7. Security Measures in Accounting Software

Security is paramount when handling sensitive financial data, so it's essential to choose accounting software that implements robust security measures to protect against cyber threats and data breaches. Look for features such as data encryption, role-based access controls, multi-factor authentication, and regular security updates and patches. Additionally, choose accounting software vendors that comply with industry standards and regulations, such as PCI DSS for payment card data security and GDPR for data protection and privacy.

8. Trends in Accounting Software Development

The accounting software landscape is evolving, with trends such as cloud computing, artificial intelligence, machine learning, and blockchain technology shaping the future of financial management. Artificial intelligence and machine learning technologies are being used to automate repetitive tasks, such as data entry and categorization, and provide predictive analytics and insights into financial performance. Blockchain technology is being explored for its potential to improve transparency, security, and auditability in financial transactions and record-keeping.

Conclusion

Accounting software plays a crucial role in streamlining financial processes, enhancing efficiency, and enabling informed decision-making in businesses of all sizes. In January of this year, Forbes Advisor ranked its top 10 Accounting Software packages for 2024, which included QuickBooks (best for comprehensive features), Xero (best for advanced features), and NetSuite (best for automation). Billsby enables its customers to integrate with all the best accounting software accounting packages and also offers scalability, accessibility, and real-time collaboration, enabling customers to access their financial data from anywhere, on any device. By choosing Billsby as your billing software solution, you can unlock your full potential and achieve sustainable growth in today's competitive landscape.

About Us

Billsby is a sector-leading cloud-based subscription billing engine, helping businesses manage the issuing of invoices and the collection of recurring payments, whilst providing award-winning customer service support. Ranked by G2 as the Number 1 subscription billing platform, Billsby streamlines billing operations, offers flexible subscription management, integrates with various systems, and provides real-time analytics, enhancing efficiency and scalability. Billsby provides the simplest and easiest solution for businesses choosing to adopt a subscription billing model, helping them to maximize their subscription revenue potential. For more in-depth guidance and bespoke solutions, visit www.billsby.com today.