All stakeholders are emphasizing that customers get their credit card information tokenized. But what is credit card tokenization? What effect does it have on the customers and merchants? Read everything your business needs to know about credit card tokenization here.

What is Credit Card Tokenization?

When making an online payment using your credit card, you need to enter your credit card details such as the card number, owner’s name, expiry date and CVV. The merchant then stores these details using masking and other security measures.

In the process of tokenization, the number of your card is replaced by a random token number which the banks and the payment processors use to make payments to and from your account. Thus, card tokenization is the process that protects sensitive data by replacing it with a token or a number which is generated algorithmically.

How Does Credit Card Tokenization Work?

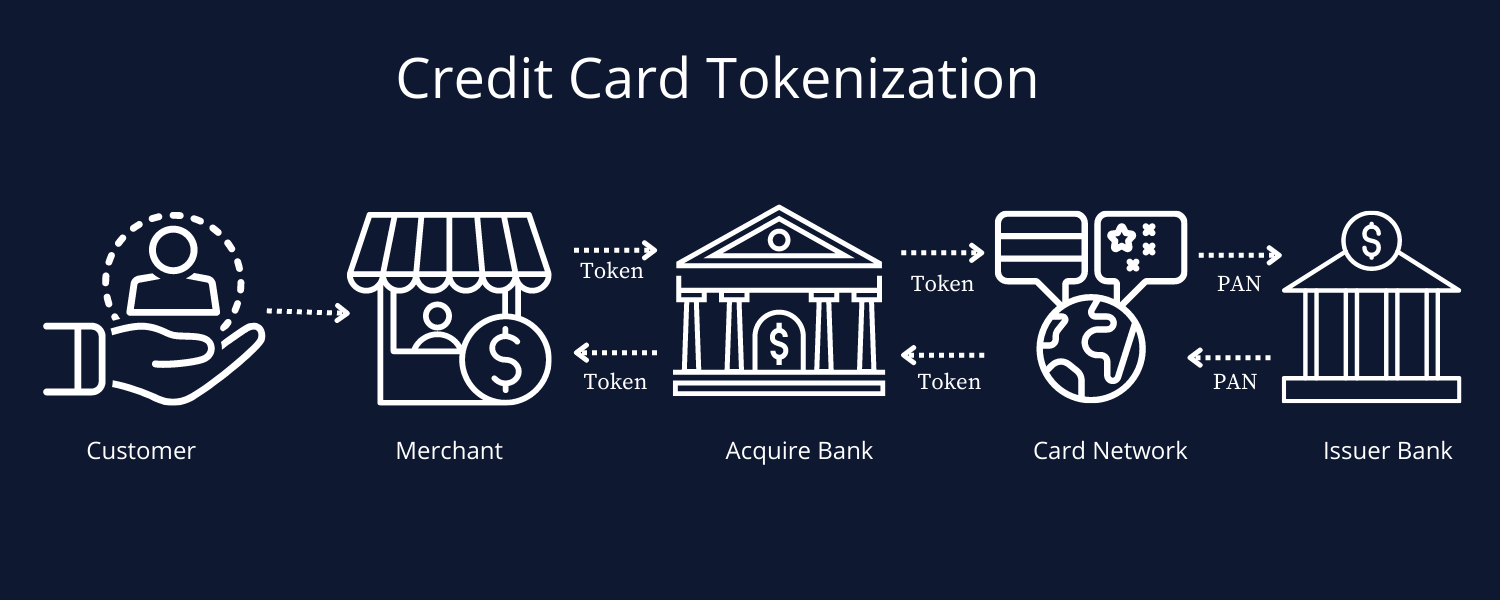

Credit card tokenization works by substituting the customer's sensitive data with a one-time alphanumeric ID, which does not have any connection to the account owner. This token is then used to retrieve and transmit the customer's credit card information safely.

The tokens do not contain sensitive customer data but navigational codes that take the banks to the customer’s data. They are generated using mathematical algorithms and thus cannot be reversed once created. They can only be accessed and opened after a successful transaction and have no value outside the system.

Credit Card Tokenization Works In The Following Steps-

1. The cardholder initiates the transaction by entering their sensitive credit card data.

2. The merchant receives the credit card information in the form of a token.

3. The receiver transmits the token for authorization by the credit card networks.

4. After authorization, the bank matches the customer data stored in the bank's virtual vaults with the customer's account number.

5. Then, the bank verifies the funds and accordingly allows or declines the transaction.

6. If the authorization is successful, the bank returns the unique token to the merchant for the current and future transactions.

This whole process occurs behind the scenes through the technology of the bank and the merchants. And the customers need not do anything additional.

Why Is It Important?

The generated tokens can only be read by the payment processor and cannot be monetized or used in any other form. Therefore, if a hacker or a thief tries to breach the security and unfortunately even gets access to the tokens, they cannot use this information to commit a cybercrime.

With the help of card tokenization, merchants can comply with PCI DSS without making hefty security expenses or generating liabilities. Also, the merchants can remove the customers' credit card information from their platform so that the risk of a data breach is reduced significantly.

Therefore, credit card tokenization alleviates the additional expenses incurred by the merchants and payment gateways on data protection. In addition, card tokenization technology can also protect other sensitive business data such as passwords, addresses, confidential files, and accounts etc.

Examples of Credit Card Tokenization

Tokenization of credit cards works on multiple channels, from mobile applications to call canter solutions and eCommerce platforms. Some of which tokenization can be provided in various channels are mentioned below.

● Ecommerce

● Within Applications

● Contact Centers

Benefits of Card Tokenization

While we all know that credit card tokenization can help secure customers' data in many ways, let us dive into the benefits of tokenization.

1.)Enhanced safety

However, only the last four digits of your card are available online after card tokenization, and you have to re-tokenize your card in case it is lost or stolen, or you get a new card.

2.)Faster checkouts

3.)Reduction in false declines

4. Easier card management

5. Physical card not required

6. Other benefits Some credit cards also offer exclusive benefits to customers when they tokenize their credit cards.

Tokenization vs Encryption

Encryption is the cryptography of your credit card information and safeguards sensitive data by converting it into unreadable code. Here, every number and letter on the card is encrypted and disguised with a different number or letter, which is chosen automatically by a sophisticated encryption algorithm. In the end, this information is decrypted with the help of a key or a password.

The significant difference between encryption and tokenization is that encryption is reversible while card tokenization is not. This is because the algorithm behind an encryption is known, and thus it can be returned to its original form at any point.

Also, card tokenization is a more robust security measure than encryption, which is breakable. The PCI council counts encryption as sensitive, and thus, complying with encryption is more expensive and tedious compared to tokenization.

Another difference between the two is that encryption is a sturdy data protection method in cases of transactions where the card is present physically. On the contrary, tokenization is a better form of protection in payments where the card is not physically present. However, encryption and tokenization must work together to ensure the most stringent security for sensitive card data and comply with the PCI DSS requirements.

Errors Related To Card Tokenization

X-pciBooking-Tokenization-Errors.

X-pciBooking-Tokenization-Warnings.

● Luhn error- The card number does not match the format of the Luhn algorithm meaning the number is too short or big.

● Expired card- The expiry date of the card has passed.

● The number has less than 12 digits- The card number entered is too short to be that of a valid card.

● Number longer than 22 characters- The card number entered is too long to be that of a valid card.

Apart from these, there are a few tokenization warnings that the customer is informed of. These issues do not stop the PCI booking system from tokenizing the card, but they might be a problem. Some warning messages are-

● Card type validation message- the card type does not correspond to the card number.

● Card type is missing- there is no card type in the request.

Final Words

Credit card tokenization is the most efficient and tech-friendly way of modern times that helps you secure your credit card details online. In today’s world, when most of the payments we make are online, thefts and frauds have become easy for criminals and credit card tokenization is your way out.

So, did you get your credit card tokenized yet? If the answer is no, why not try Billsby today! We tokenize all payment information that is captured and stored by us.