Customer acquisition cost, or CAC, is a critical business indicator used by companies all over the world to evaluate the resources required to attract new customers and maintain growth.

If you want to grow your client base while still making a profit, you need to know what CAC stands for, what it means for your business, and how you can calculate it.

But first, here's a table of contents to assist you in finding exactly what you're searching for.

Table of Contents

1.)What is customer acquisition cost?

2.)How to calculate customer acquisition cost?

3.)Customer acquisition cost formula

4.)Potential customer acquisition costs

5.)Importance of customer acquisition cost

6.)What is Customer Lifetime Value (CLV)?

7.)Customer acquisition cost benchmarks in SaaS

8.)Customer acquisition cost by industry

9.)How to improve customer acquisition cost?

10.)Conclusion

11.)Customer acquisition cost FAQs

What is customer acquisition cost?

Customer acquisition cost, or CAC, is and approximation of the total cost of acquiring a new customer. In other words, CAC refers to the resources and costs associated with obtaining a new customer. Generally, this should include things like advertising costs, salaries of marketing staff, cost of salespeople etc.

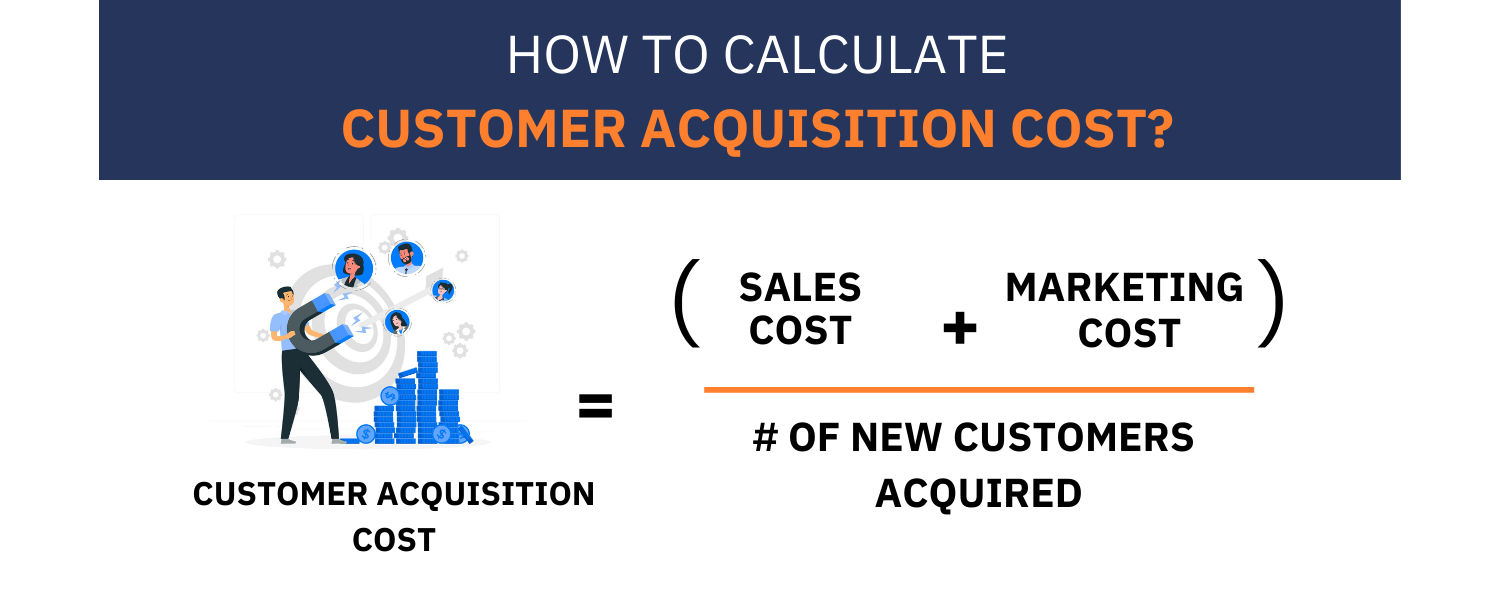

How To Calculate Customer Acquisition Cost?

To determine the customer acquisition cost, you need to add up the costs of attracting new customers. This is typically the amount of money you’ve spent on marketing and sales. Once you have a total cost you need to divide that by the number of potential customers you’ve attained to find your CAC. This is usually calculated over a set period, such as a year or a financial quarter.

Let’s assume your business spends $500K on sales and $300K on marketing in one financial quarter. In that quarter your company gained 800 new clients. As a result, the average customer acquisition cost for that quarter would be $1K ((500K + 300K)/800= 1K).

Customer Acquisition Cost Formula

The following formula can be used to calculate customer acquisition costs-

Potential customer acquisition costs

When using the customer acquisition cost formula you should consider including the following expenses when determining your cost of marketing and sales -

➢Creative costs The amount you spend on content creation is termed creative costs. This could be expenditure incurred on hiring new employees to help your business grow, or it could be money spent on lunch for your team meeting. All of these expenses are factored into the content creation process.

➢Technical costs Technical costs are the costs attached to the technology that’s required by the marketing and sales team. For instance- if you purchased reporting software that traces the progress of your deals, this would be a technical cost.

➢Publishing costs This includes the expenditure of releasing marketing campaigns, TV airtime, columns in newspapers, or paid social media ads.

➢Production costs These include expenses related to physical content creation. For instance, if you need to buy a new camera for video creation this would be considered a production cost.

➢Advertising costs This is the money spent on advertisements. Advertising is a great way to boost your business and attract new customers. But for your ads to work, your campaigns must appeal to your target audience, and most of the time lead to additional costs being incurred.

➢Inventory upkeep Despite being a SaaS company, you'll have to spend money on product maintenance and optimization. This expense includes utility expenses and facility storage fees for enterprises that sell tangible products. If you’re selling software, this also includes money you'd spend on patches and updates for a better user experience.

Importance Of Customer Acquisition Cost

Once time passes and you’ll begin to identify how long it has taken to recover from your calculated customer acquisition cost and produce a profit. Tracking this is what makes this measure vital for any business as without it, you won’t know when you’ve started to make a profit. It also has other benefits for your business:

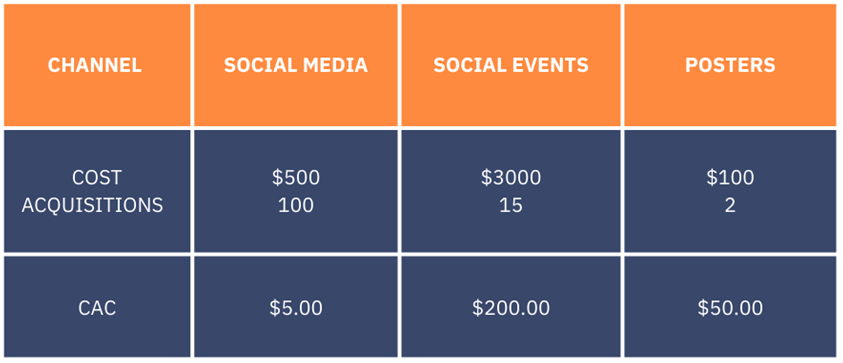

1.)Improves Return on Investment (ROI)

A corporation can find the most cost-effective strategy to attract customers by utilizing the customer acquisition cost metric. For instance, we can see from the table above that social media has the lowest acquisition cost, while social events have the highest. If this information is available to a business, it may help them decide to increase their use of social media marketing to attract more customers.

2.)Improves profitability and profit margin

Determining your company's customer acquisition cost allows you to thoroughly examine its value per client and increase your profit margins. For instance, consider a case where each customer is worth $60 to a company.

Using the table from the previous example, which channel would you choose? Choosing to employ social events as a channel would have a negative impact on profitability for a company when their customer is only worth $60. In this case the company would be better to choose the social media or poster channels when acquiring new customers.

Customer Lifetime Value (CLV) vs Customer Acquisition Cost (CAC)

The lifetime value (LTV) of a customer is an essential metric to consider when calculating customer acquisition costs.

LTV is the expected revenue generated by a single client over the course of their engagement with a company. The customer acquisition cost (CAC) on the other hand is the cost of acquiring a customer. Once a business has both these metrics, they can compare them to determine their profitability.

To calculate LTV you'll need the following elements:

1.)The total number of purchases made within a given period. Note that a multi-month subscription represents one purchase for a SaaS company, and lies in the period in which the transaction occurred.

2.)The total number of unique consumers who purchased within the same period.

3.)Average customer lifespan.

Using the total number of unique customers and their purchases in a given period you can divide the latter by to former to obtain the average value per customer. You can then multiply this but the average customer lifespan to get the LTV. This will provide you with an estimation of how much income an average customer can earn for your business over the length of their engagement with you.

As a result, your firm's LTV to CAC ratio, or LTV: CAC, is a rapid assessment of a customer's worth vs the cost of acquiring them.

Customer acquisition cost benchmarks in SaaS

Your overhead expenditures as a SaaS company owner are far lower than they would be in any other industry. The majority of your budget is spent on expanding your company. As a result, marketing spending serves as a forewarning of profitability.

You should be obtaining more value for money than what you're putting in, but what’s the benchmark? If a software company grows at only 20% a year, it has a likelihood of going out of business in five years because it only has a 1.2 LTV/CAC ratio.

What's the lowest point at which you're likely to succeed? 3.9. Every dollar spent on obtaining a new customer should result in at least $3.90 in revenue.

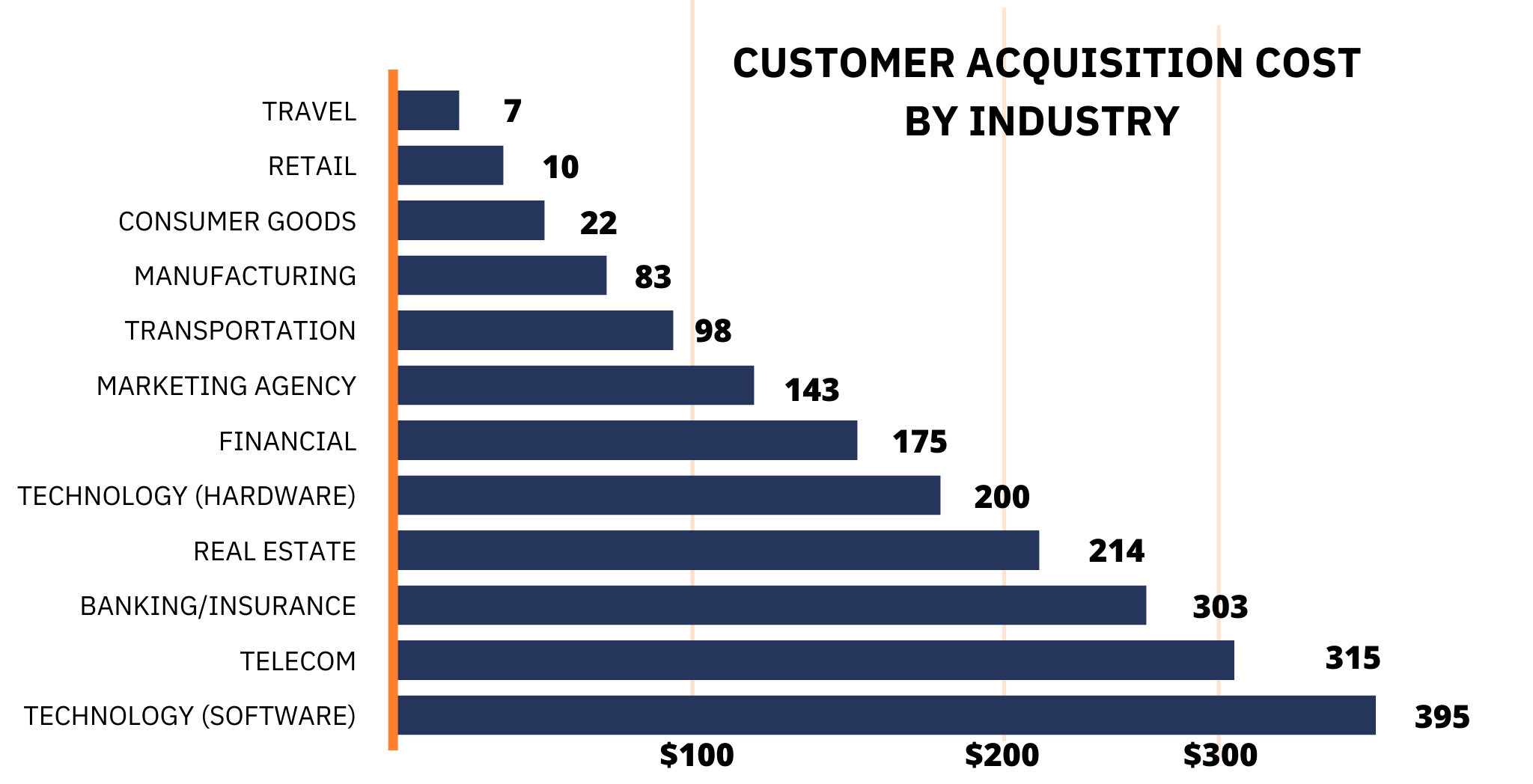

Customer acquisition cost by industry

The customer acquisition cost varies by industry due to a variety of factors, including but not confined to:

● The time it takes for a sale to close

● Value of the purchase

● Frequency of purchases

● Customer life expectancy

● Maturity of the company

Thus, to put CAC into perspective here's a breakdown of average customer acquisition cost by industry (as assessed by several publications):

● Travel- $7

● Retail- $10

● Telecom- $315

● Financial- $175

● Real estate- $213

● Manufacturing- $83

● Transportation- $98

● Marketing agency- $141

How to Improve Customer Acquisition Cost?

1.)Invest in conversion rate optimization (CRO)

Make it as easy as possible for visitors to convert into leads or for leads to turn into customers and thus generate transactions on your site. For example, improve your website for mobile form registrations and shopping, examine website language for clarity, and strive to build a touchless sales procedure so your visitors can buy from you at any time.

2.)Contribute value

Increase consumer value by providing them with what they want. Collect customer feedback and do your best to offer them what they want, whether it's a product solution, a new feature, or a supplementary product offering, to keep them coming back.

3.)Implement a customer referral program

If you get a warm lead from your customer network who is already eager to learn more about your product or service, their customer acquisition cost will be $0 if they convert. Build a client referral program that your customers would like to participate in, and these "free" customers will lower customer acquisition costs over time.

4.)Simplify your sales cycle

Reduce the duration of a typical sales cycle to boost the number of sales you can impact in a year. To interact with more potential leads more effectively, use CRM and prospecting solutions.

Conclusion

You can only make strategic business decisions and anticipate how lucrative your company will be in the long term if you know how much it costs to bring in new consumers.

Customer acquisition cost can be used by investors to determine whether or not they believe your company is profitable now and in the future. In addition, it may help businesses allocate resources and cash, plan marketing initiatives, and guide them through the hiring and compensation process.

Billsby is the best money you'll ever spend if you're serious about lowering your CAC. It allows you to automate subscription management and invoicing so you can focus on creating the ideal product – and earn profit from it. Book a demo now.

Customer acquisition cost FAQs

1.)How to calculate cost per customer acquisition?

Simply divide the overall cost of marketing over a specific period by the total amount of new consumers in that same period to determine the cost per acquisition.

2.)What is a good customer acquisition cost?

Companies will most frequently compare their customer lifetime value to their customer acquisition cost. Although it will vary widely for various businesses, a CAC: LTV ratio of 1:3 is typically considered a decent ratio.