With the execution of the ASC 606 revenue recognition, the companies in the US have started adhering to the new standards. However, there is still a lot of perplexing regarding various aspects of ASC 606, and how it will impact multiple industry types. In this article, we will read in detail about the ASC 606, including its 5-step model and its potential impacts on various business types such as SaaS.

What is ASC 606?

ASC 606, also known as revenue recognition, is the new method for accounting and disclosure of revenue and other financial statements related to it. It is meant to affect all the entity types that produce financial statements, and come into some kind of contract with their customers. All the concerned entities and some benefit plans for employees were mandated to adopt the ASC 606 for the financial year beginning after December 15, 2017.

Most businesses started complying with the new ASC 606 revenue recognition, including SaaS companies in the financial year of 2018. However, all other entities which were not in the group mentioned above began adhering to the ASC 606 on December 15, 2018.

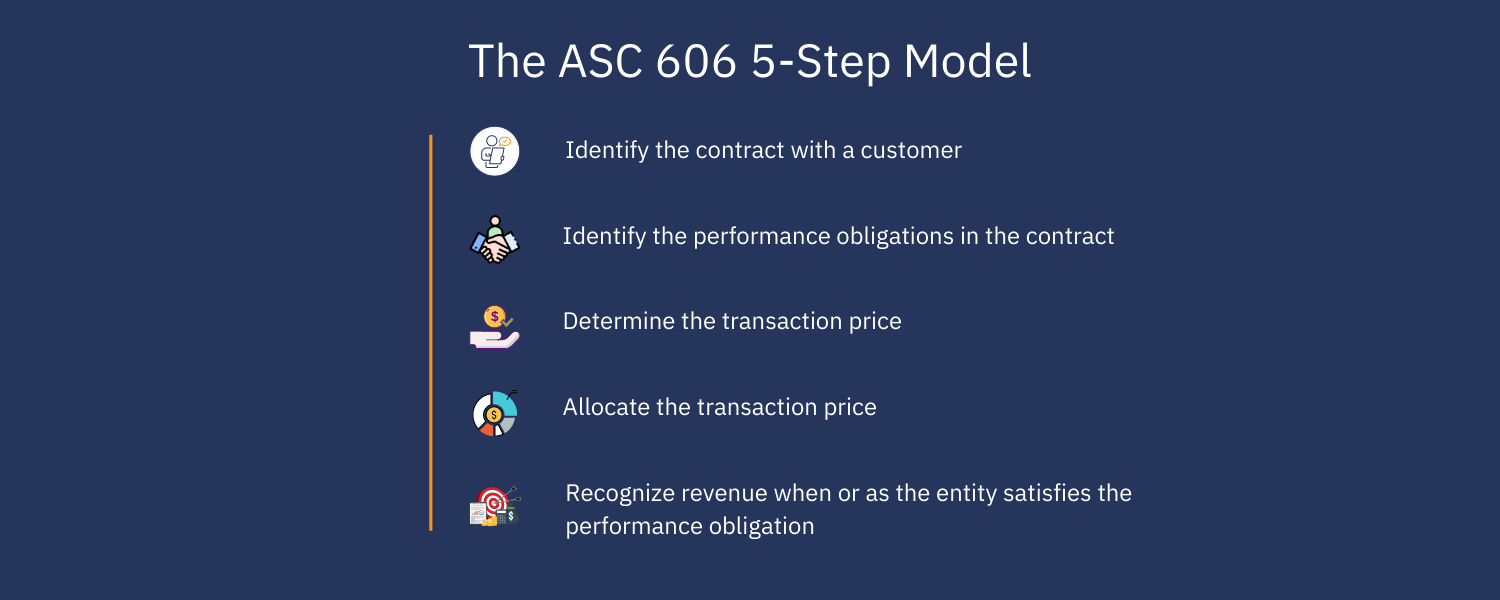

The ASC 606 5-Step Model

In a subscription business, the payment for goods and services is made by the customer at the beginning of the contract period. However, it can be considered revenue only if it is earned over the contract period of the concerned customer.

The FASB and IASB, keeping in mind the essential aspects of a business such as consistency in financial reporting, improvement of comparative analysis as well as reporting, etc, have prepared a 5-step model for revenue recognition.

The breaking down of the contract process by ASC 606 revenue recognition in 5 steps is mentioned below-

1. Identification of the contract with a customer- This step of the model should be met while establishing a contract with the customer for supplying the commodities. The essentials of a contract include that-

● The agreement is approved by all parties

● All parties are ready to fulfil their obligations

● The rights of each party are identifiable

● The terms of payment are clearly identifies

● The contract stands with a commercial substance

● The collectability is ensured

2. Identification of the performance obligations in the contract- This step of the criteria tells how to handle the distinct performance obligations in the contract. A service or a good is distinct if the customer can benefit from it or it can be transferred without breaking any performance obligations of the contract.

3. Determination of the Transaction Price- This step lets you know what things should you consider while establishing the transaction cost. Transaction cost is the amount that the business experts receive for transferring the commodities to the consumer.

4. Allocation of the Transaction Cost- The transaction cost received must be allocated productively. To cover this process, the fourth step is established in which allocation of the transaction cost across the contract’s discrete performance obligations and the price at which the customer is willing to pay against the goods and services.

5. Recognition of the revenue when or as the entity satisfies a performance obligation- Recognition of the business is on behalf of each performance obligation. With this step, it is easily specified how that should happen.

What is the Impact of ASC 606?

With the beginning of the fiscal year, effective from Dec. 15, 2017, the rule of “Revenue from Contracts with Customers” which speaks about the simplified and standardized method of recording revenue in customer contracts has started showing its impact on the economy.

This whole covers every detail of how businesses report the nature, amount, and timing in regards to contracts with customers.

When we talk about the impact of ASC 606, some are of the opinion that it will be improving the upcoming fiscal year’s financial results. But the matter of fact is that, if any organization steadily shows improvement in its revenue, then it will become more difficult to recognize the organic growth of that organization for instance, with an increase in the customer base and the number of subscriptions sold.

With the release of analytics of recent earnings by Audit Analytics, the data census identifies that there are nearly about 70 companies that are noted as ASC 606 with the context of their 2018 guidance. Among them all, there were almost 20 companies that quantified an effect on the expected earnings per share (EPS).

On the basis of the Preliminary Sample, the companies which had a negative impact were more likely to quantify the impact on expected earnings per share. This was the case with 6 of the companies out of all the 10, whereas the rest of the 4 companies said that the impact was well expected to be immaterial.

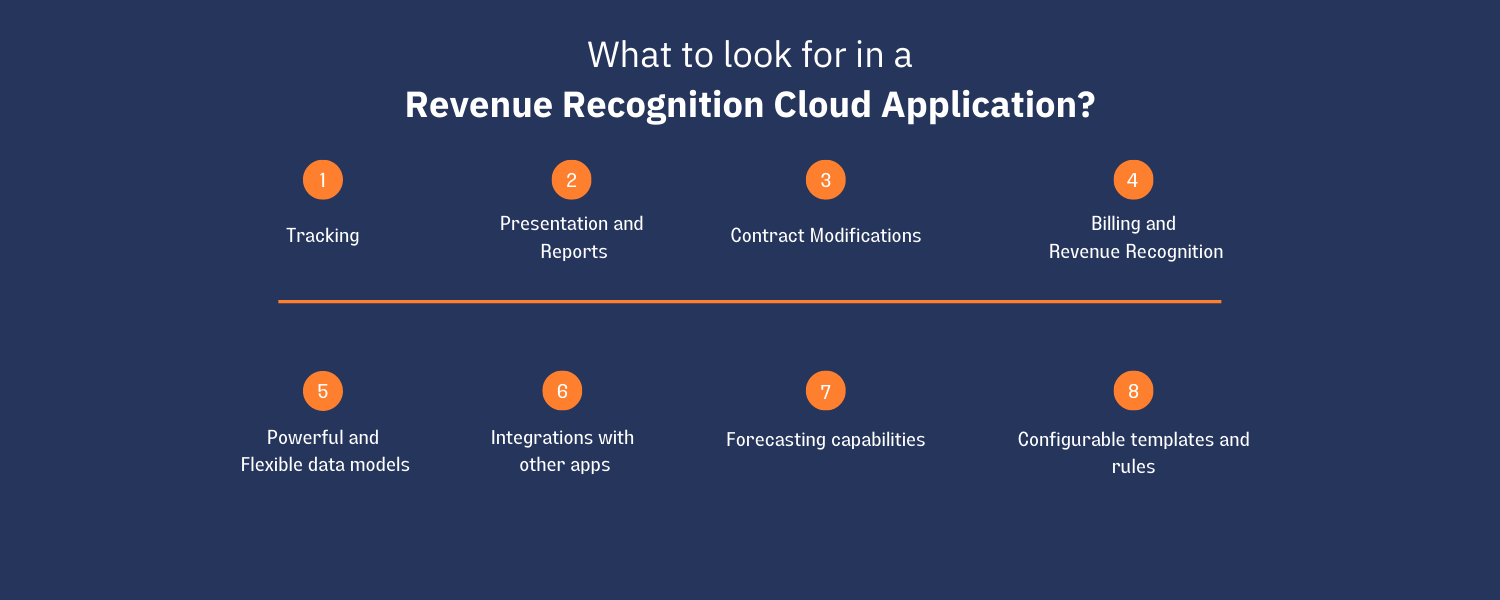

What to look for in a revenue recognition cloud application?

Before choosing the best revenue recognition cloud application for your SaaS business, you should completely assess the technology it deals with and the benefits and features it offers. A few basic system requirements that you should look for in a technology solution for revenue recognition can be seen below-

1. Tracking-

Based on the 5-step model of ASC 606, a technology for revenue recognition should be able to track the contracts of the service with their customers. The five steps, including identification of the contract with the customer, identification of performance obligations, determination of the transaction price, allocation of the transaction price to each PO and the recognition of the revenue when the POs are satisfied, should be well-tracked by the revenue recognition cloud application.

2. Presentation and Reports-

A good software provides data and reports to the companies regarding the net contract asset or liability balances. Apart from this, receivable balances if any should also be reported by the software. Generally, reporting receivable balances accurately is a task which not all revenue recognition cloud applications are able to perform. Also, being able to present it in the form of a dynamic presentation to make everything highly understandable is also a plus point.

3. Contract Modifications-

Any changes to the variable considerations of modifications in the contract should be handled by the software seamlessly. The basic examples of considerations include refunds, penalties, bonuses, etc.

The ASC 606 makes it mandatory for the variable considerations to be estimated and added to the final transaction price that is applied in the performance obligations.

It is also necessary for the app to monitor contract modifications continuously and assess them to determine accurate accounting. This also includes ongoing changes to the transaction price along with revenue catch-up adjustments, which can be recent for organizations. It is a quite complicated process, and thus efficient software should be able to handle the complexities efficiently.

4. Billing and Revenue Recognition-

Apart from being a revenue recognition engine, software should also be integrated with billing and collections. According to ASC 606, the organizations must provide the net asset and liability position for every contract by incorporating cash collections (that include the cash collected upfront).

Billing and revenue recognition cannot go side by side as per 606, and it might require you to recognize a receivable that is unbilled. Therefore, a revenue recognition cloud application should be able to perform this task efficiently.

5. Powerful and Flexible data models-

The correct tool is able to recognize revenue from a plethora of sources such as opportunities, orders, invoices, contracts and projects. In the constantly multiplying revenue models from Saas which are product based to usage-based contracts, it is important that your cloud service is able to handle complex cases such as multi-element arrangements.

6. Integrations with other apps-

A good revenue recognition cloud-based app will allow you to integrate directly with applications such as customer relationship management and professional services automation so that you can make complete use of your existing platforms such as Salesforce to make your revenue recognition experience seamless.

7. Forecasting capabilities-

Allowing you to go beyond retrospective reporting to acquire a comprehensive image of the business is an essential feature of a good cloud application that deals in revenue recognition. With this, you can derive revenue forecasting with forecasted as well as recognized values on different revenue source data.

8. Configurable templates and rules-

The right tool helps you to adapt to the things coming next. You can create rules customized according to your needs in ways you want to recognize revenue. Therefore, you should search for a cloud-based app that adapts your business style, and not the other way around.

While understanding ASC 606 might still be a challenge for many, its benefits are inevitable. It offers a transparent and easy system for both the authorities and the organizations. Complying with the ASC 606 guidelines is not a tough job, especially when done with the help of an efficient application.

The most advanced technology in this regard is cloud technology, which is offering a plethora of options for customizations for the process of revenue recognition to the various industries.

FAQs

Q- How does ASC 606 change revenue recognition?

Ans- The basic principle of the ASC 606 relates to the process of the entities recognizing revenue in order to reflect the transfer of goods and services to their customers in an amount that is equal to the consideration which the entity expects to receive in exchange for the respective goods or services. It comes out as robust guidance that holds the revenue recognition changes, which can affect the financial statements of a company.

Q- Does ASC 606 apply to private companies?

Ans- Yes, it is applicable to private companies as well. According to ASC606, both public and private entities should comply with the ASC 606 in regard to the 2017 and 2018 deadlines.

Q- Does ASC 606 replace ASC 605?

Ans- Yes. The ASC 606 replaced the previous ASC 605 with the aim of bringing GAAP revenue recognition standards to the US to facilitate a better compliance level with the International Financial Reporting Standards.

Q- When did ASC 606 become effective?

Ans- The ASC is effective for fiscal years after December 15, 2017. This means that for most businesses, it became effective on January 1, 2018, in the US.

Q- Does ASC 606 apply to governmental entities?

Ans- ASC 606 is applicable to all business entities including public, private and non-profit companies that come into contracts of providing goods and services to the customers.

Q- Does ASC 606 apply to an income tax basis?

Ans- ASC 606 affects the taxpayers and their tax reporting in ways such as-

● Tax accounting method changes

● Book-tax difference

● Deferred taxes

● International tax planning and reporting

● Sales and use of indirect taxes.